I mentioned in this post that we are thinking of opening a Roth IRA in my husband’s name. We already have one for me. But why would we do that if we haven’t maxed out his contribution to his 401K plan? Because we want to diversify our retirement portfolio.

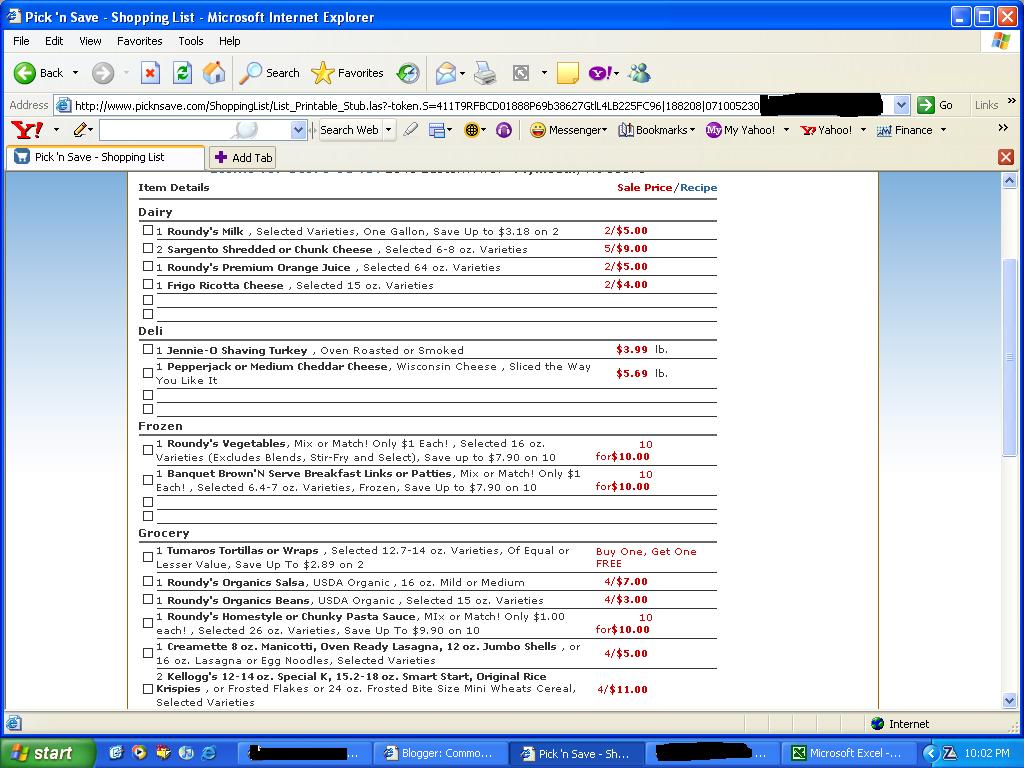

When people talk about diversifying their portfolios they are usually referring to saving on a mix of stocks, bonds and cash. But they forget that it is also important to invest on a mix of taxable and non-taxable accounts. We are investing for retirement in both a 401K account and a Roth IRA. Why do we do that? Because we want to shelter some of our retirement savings from being taxed when the time of taking distributions comes around.

In Money Magazine May 08, there is an article that states that tax rates are at one of its lowest points currently. Did you know that at some point tax rates where up to 70%. I think most of us are too young, or where not paying taxes at the time to know what that was like. The fact is that tax rates are currently very low and with government funded programs such as Social Security or Medicare needing a transfusion very soon, a tax hike is not out of the question.

But we invest in a Roth IRA not only because we expect tax rates to be higher in the future but also because we think we are paying less taxes now than we will in the future. Currently we have children we can claim as dependents, a mortgage that allows us to take a tax deduction. But we expect that as the time to retire gets near we will become empty nesters and we certainly hope not to have a mortgage payment by then. With less deductions we can expect to pay more income taxes and we would like to be able to use more of our retirement income to live on not to pay taxes with. Hence the reason we are protecting some of it now by investing in a Roth IRA.

There are other good reasons to save on a Roth IRA too. A Roth IRA can serve as an emergency fund for you. Of course having an emergency fund is always best. But for times when those savings are not enough you can also tap into your Roth IRA up to the amount you have contributed without paying any penalties or having to worry about paying the money back like a 401K loan. Also, you can use it as a way to save for college. You have heard it before, you can borrow money for college but not for retirement. Say right now you think it is best to focus on saving for retirement, when the time comes for your children to start college you think you are in a position to devote some of your retirement savings to pay for it, a Roth IRA allows you to withdraw any money you have contributed without paying taxes on it.

There are few things in life that are certain, taxes being one of them. When planning for your future don’t leave them out of the equation. For us, I think it will be nice to use our retirement savings to enjoy our final years instead of seeing Uncle Sam keep a good chunk of them.