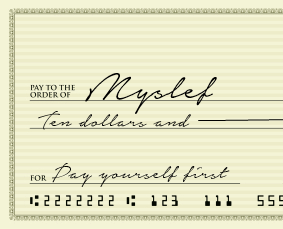

“Pay yourself first!”

You’ve probably heard this advice more than once when looking for ways to grow a savings account or build a nest egg. But what exactly does it mean?

Paying yourself first means that you put money into your savings, or pay yourself, first before you pay anything else or spend any other money. The idea to pay yourself first is really a great one when you’re trying to save money; by socking that away immediately, you shouldn’t miss it.

However, paying yourself first is sometimes easier said than done, especially if you have a low or limited income. Here are some tips that should help you pay yourself first and accumulate a nice chunk of savings.

Start Somewhere

If you have a low income, you might have some trouble starting when you want to pay yourself first. The trick is just to start, even if you start with a small amount. Try starting with $1 a week, and steadily increase this amount periodically. If you end up with an amount that’s too high and you’re having trouble meeting your other financial obligations, you can decrease the amount you pay yourself first. Eventually, you’ll reach an amount that you’re comfortable with.

Make It Automatic

One of the great things about modern technology is that you can pay yourself first automatically. If you get paid by direct deposit, set it up so the pay yourself first amount gets deposited into your savings account. You can also schedule regular bank transfers from one of your bank accounts directly into your savings account. If you’re able to direct money into your savings account automatically, you’ll be much less likely to forget or skip a deposit.

Play Hard to Get

With your savings, that is. Try to set up an account that makes it difficult for you to withdraw the money whenever you want. You might set up an account in another town, for instance, or create an account through an online bank, like Ally. If your bank offers you a debit card when you set up an account, refuse it. By not having easy access to the account, you’re much more likely to let the money you pay yourself first accumulate and grow.

Set Goals

Don’t blindly pay yourself first. Instead, set goals and figure out exactly how much you need to put into your savings account to meet those goals. You might make a goal to save $1,200 in a year, which means you’ll need to put $100 into savings each month. If you aren’t putting enough money into your account by paying yourself first, add extra money when you can. Put all of the money you have leftover from the previous pay day into savings, for instance, or put unearned income, like your tax refund, into savings as well.

Don’t Obsess

The old saying “a watched pot never boils” is true in many situations, including the pay yourself first concept. Although you should monitor your account for any unusual activity, try not to watch it constantly and obsess over it. After you pay yourself first, look for any unauthorized withdrawals and leave it at that. If you constantly watch your account and believe your balance isn’t growing as fast as you think it should, you could get into the mindset that trying to save money isn’t worth it and quit. Remember – a little money in savings is much better than none at all.